In this article, we explore TrickBot targets in configuration version 1000024 (“v24”), which was operating in June 2017. F5 Security Operations Center (SOC) researchers continually track TrickBot target and publish reports in conjunction with F5 Labs researchers. Our efforts are to understand the malware author’s behavior and notify the targeted institutions so they can be on alert for TrickBot fraud within their environments.

Key data points from v24 analysis:

- 95% of TrickBot v24 URLs were identical to those targeted by Dyre in 2015, adding to the growing list of commonalities between Dyre and TrickBot.

- 62% of the targets in v24 were also targeted in v18 and v19, which were active in May, suggesting the target list always started from Dyre targets.

- v24 included a spike in Nordic targets—primarily UK, Sweden, Switzerland, Finland and Norway targets, as well as a large reduction in URLs in Australia and New Zealand.

- Clear focus on wealth management financial institutions that service individuals and businesses.

- Targeting both retail (personal accounts) and commerce (business accounts) banks.

- Targeting Islamic banks in UAE, UK, and Jordan.

TrickBot 101

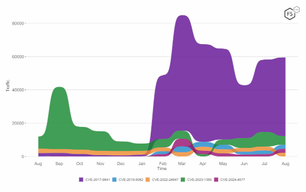

TrickBot infects its victims much like any other banking trojan that begins with social engineering attacks, such as phishing or malvertizing, to trick unassuming users into clicking malware links or downloading malware files. Once a user engages with the malware and it’s able to exploit the user’s system (because of out-of-date patches and AV software—the exception would be zero-day malware), the malware installs and controls the host via commands from its command and control (C&C) server.

Figure 1: Initial TrickBot attack path

Figure 1: Initial TrickBot attack path

TrickBot’s Dynamically Updating DLL Module

TrickBot has a basic configuration file that is written when the malware initially infects a victim’s system. This configuration file specifies the malware’s version, its C&C servers (that are set up on compromised IoT devices, specifically wireless routers1), and modules to be fetched and installed by the malware.

“injectDll” module is the core banking module that contains the malware’s banking functionality, the list of targeted URLs, and servers to which the legitimate bank content is sent for modification upon receipt by the user. These files are updated frequently by the malware authors and dynamically deployed to TrickBot's infected systems.

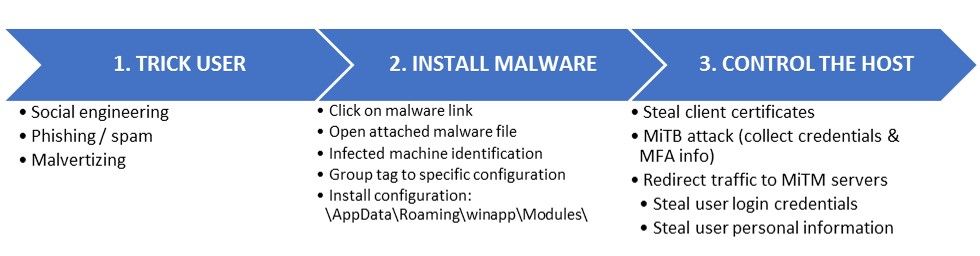

These configuration versions and the URL targets within them are what the F5 SOC and Labs researchers analyze to understand the malware author’s targets. There have been at least 29 new configuration files in the DLL module since September of 2016.

Figure 2: TrickBot configuration versions since September 2016

Figure 2: TrickBot configuration versions since September 2016

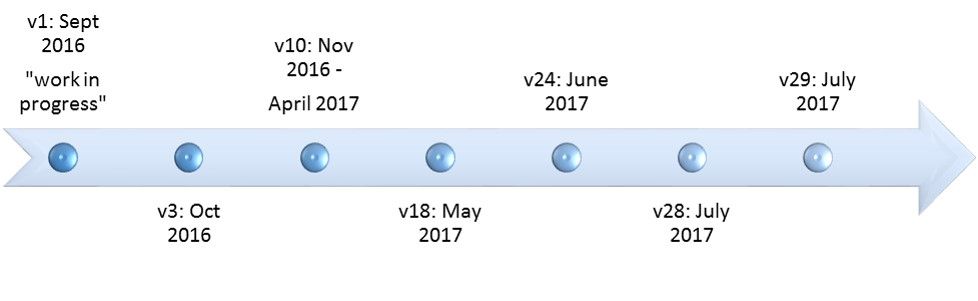

Once a user’s host is infected with TrickBot, and the unassuming user browses to their banking site (a TrickBot-targeted URL), the malware injects malicious javascripts and redirects the session to fake pages that collect the user’s data, including user credentials. The data collected is sent to “drop zone” servers, which the malware authors then uses to process fraudulent transactions on the accounts they have now have access to.

Figure 3: TrickBot post-infection attack path

Figure 3: TrickBot post-infection attack path

TrickBot v24 Targets

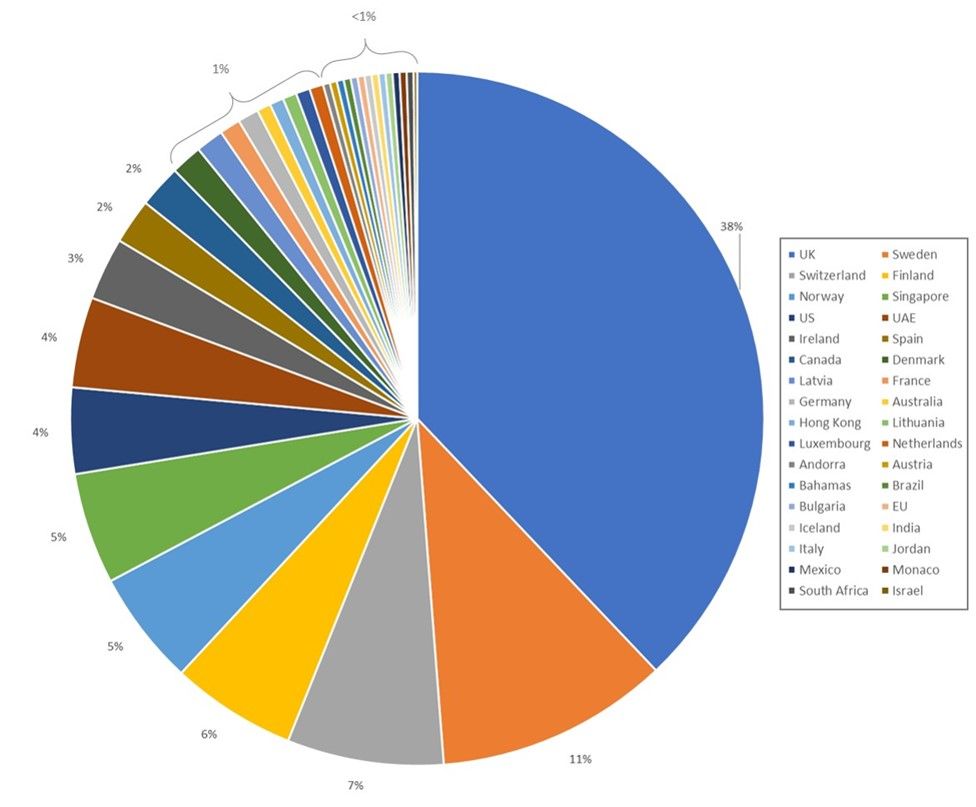

There was a large expansion in targets from the previous configurations (v18 and v19) we analyzed2 that were active in May. Configurations v18 and v19 included 210 and 257 targeted URLs across 13 countries and 155 businesses. Configuration v24 targeted 618 URLs, a 240% growth in target URLs over v19, across 34 countries and 177 businesses (see Appendix A for list of target businesses).

Figure 4: v24 country targets by URL count

Figure 4: v24 country targets by URL count

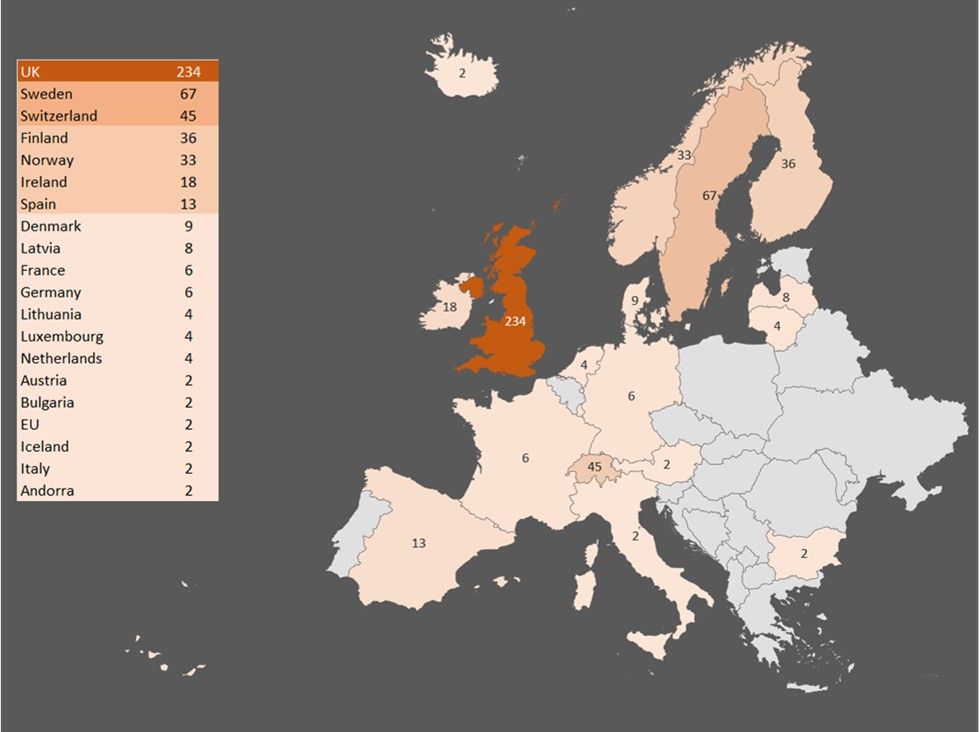

European banks were the focus of TrickBot’s targets in v24, comprising 81% of the URL targets. The primary targets were in the UK, Switzerland, and the Scandinavian countries of Sweden, Finland, and Norway; the UK and Sweden were collectively nearly 50% of the targets. Some of the banks targeted in those countries are foreign banks where the localized country domain was targeted, indicating the attackers are going after customers of those banks in those countries rather than targeting every country in which the bank operates.

Figure 5: v24 European targets: URL count by country

Figure 5: v24 European targets: URL count by country

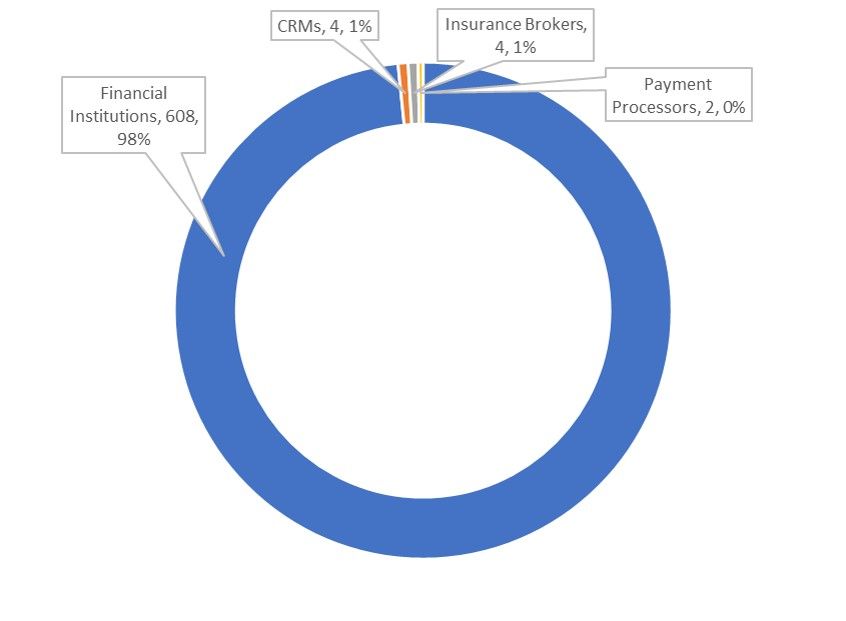

Ninety-eight percent of the targets were financial institutions, including public and private banks focusing on both retail and commerce, wealth management services, retirement and investment firms, co-ops, internet banking, Islamic banking, savings banks, loan providers and clearing banks. The CRMs and payment processors are consistent from previous configurations, the insurance brokers are new since v18 and v19, however, those insurance brokers had banking divisions in the past. It could be that since these targets were pulled from Dyre circa 2015, it’s likely they were targeting the banking division.

Figure 6: Targets by Industry

Figure 6: Targets by Industry

Notable Target Drops

European banks have continually been a top target of TrickBot, and although there was growth in targets in that region, Europe stands out more in this configuration because Australia and New Zealand targets dropped off, thereby boosting Europe’s portion of the pie. There were no New Zealand targets in this configuration, and only four in Australia.

Another notable drop was PayPal, which drove a significant portion of US interest in previous configurations. Because PayPal was not targeted this time, the US dropped in overall % of targets.

TrickBot Targets are Directly from Dyre Circa 2015

What’s most interesting about the URL targets is that they replicate Dyre’s targets from 2015.3 Ninety-five percent of the URLs in TrickBot v24 were also targeted by Dyre in 2015. It is widely believed that TrickBot and Dyre were written by the same authors because of code similarities. Specifically, they have the same loaders, encryption and decryption routines, structure of configuration files, and inter-process communication. The fact that both trojans target the same URLs just adds to the parallels and resulting conclusion that the same actors are likely behind both trojans.

Although almost all of TrickBot’s URLs came from Dyre, not all of the Dyre URLs are present in this TrickBot configuration. In fact, TrickBot has some URL formulations that target a specific subdomain of a bank, but it doesn’t use all the URLs for that subdomain that exist in the Dyre target list. This suggests someone is selectively choosing which URLs from the Dyre list to use.

In researching the Dyre–TrickBot connection, we noticed that Salesforce and Reynolds & Reynolds appeared on the Dyre target list in the same formulation. Therefore, it’s not actually surprising that TrickBot “expanded” into CRMs. This has been a behavior of financial malware for quite some time.

Some URLs in the TrickBot list do not appear on any published Dyre list that we found. Most of these are variations on URLs that can be found in the Dyre list. This suggests that the TrickBot authors are attempting to improve at least some of the Dyre URLs—although there are still many URLs that don’t resolve anymore. Most of the “improvements” from Dyre to TrickBot are to UK and Swedish banks.

Almost Thirty Percent of Targets Have Wealth Management Specialties

Fifty of the 177 businesses targeted specialize in or offer wealth management services. Wealthy individuals are more likely to have multiple card holders on one account (who could be in multiple global positions at the same time), and process high value transactions frequently. These types of customers also have low patience for fraud holds. This type of behavior profile makes it more difficult for banks to implement the standard behavioral-based fraud controls that most financial institutions rely on now. This could make them a great target for attackers, and perhaps is one of the reasons why the targets have remained consistent over the years, beginning with Dyre in 2015.

| Institutions with a Wealth Management Focus and/or Services | Country |

| Andbank | Andorra |

| Aktia Bank | Finland |

| Danske Bank | Global |

| Arab Bank | Jordan |

| Baltic International Bank | Latvia |

| Medicinos Bankas | Lithuania |

| DBS Bank | Singapore |

| OCBC Bank | Singapore |

| Investec | South Africa |

| Banca March | Spain |

| Banco Mediolanum | Spain |

| Carnegie | Sweden |

| Catella | Sweden |

| DNB Bank | Sweden |

| Erik Penser Bank | Sweden |

| Bank Cler | Switzerland |

| Bank von Roll | Switzerland |

| Barclays Bank | Switzerland |

| BHF-Bank | Switzerland |

| Julius Baer | Switzerland |

| Neue Helvetische Bank | Switzerland |

| Valiant | Switzerland |

| Abu Dhabi Islamic Bank | UAE |

| Mashreq Bank | UAE |

| United Arab Bank | UAE |

| Adam and Company | UK |

| Aldermore Bank | UK |

| Arbuthnot Latham | UK |

| Barclays Bank | UK |

| Butterfield Bank | UK |

| C. Hoare & Co | UK |

| Cater Allen | UK |

| Close Brothers Asset Management | UK |

| Coutts | UK |

| Credit Suisse | UK |

| Gerrard Investment Management | UK |

| Hargreaves & Lansdown | UK |

| HSBC Bank | UK |

| Investec | UK |

| J.P.Morgan | UK |

| Kleinworth Benson | UK |

| Rathbone Brothers | UK |

| St. James's Place Bank | UK |

| Standard Life Savings Limited | UK |

| Tilney | UK |

| Toronto-Dominion Bank | UK |

| Triodos Bank | UK |

| Yorkshire Bank | UK |

| Merrill Lynch | US |

| Voya | US |

Figure 7: Financial institutions targeted that specialize in wealth management

Islamic Bank Targets

Twelve Islamic banks were targeted in the Middle East and UK, all of which were also targeted by Dyre.

| Financial Institution | Country |

| Al Rayan Bank | UK |

| Arab Bank | Jordan |

| CBI | UAE |

| Commercial Bank of Dubai | UAE |

| Dubai Islamic Bank | UAE |

| Emirates NBD Bank | UAE |

| Invest Bank | UAE |

| Mashreq Bank | UAE |

| Noor Bank | UAE |

| RAK Bank | UAE |

| United Arab Bank | UAE |

| United Bank UK | UK |

Figure 8: Islamic banking targets

C&C Servers

Over 50% of the C&C addresses being used are owned by two ASNs: OVH (in France and Canada), and JSC in Russia.

| C&C Address | Port | Service | Location | ASN Owner |

| 147.135.185.124 | 449 | TCP? | France | OVH SAS |

| 149.56.35.205 | 443 | HTTPS | Canada | OVH SAS |

| 163.53.206.187 | 443 | HTTPS | India | Rainbow Communications |

| 185.208.170.211 | 443 | HTTPS | UK | Hydra Communications Ltd |

| 186.103.161.204 | 443 | HTTPS | Chile | Telefonica Empresas |

| 190.34.158.250 | 443 | HTTPS | Panama | Cable & Wireless Panama |

| 191.7.30.30 | 443 | HTTPS | Brazil | NEMESIS |

| 193.124.117.102 | 449 | TCP? | Russia | JSC Mediasoft |

| 194.87.102.151 | 445 | SMB | Russia | JSC Mediasoft |

| 195.133.144.100 | 443 | HTTPS | Russia | JSC Mediasoft |

| 195.133.48.128 | 449 | TCP? | Russia | JSC Mediasoft |

| 195.62.52.55 | 443 | HTTPS | Russia | IT Expert LLC |

| 37.59.183.143 | 443 | HTTPS | France | OVH SAS |

| 46.160.165.31 | 443 | HTTPS | Russia | UGMK-Telecom LLC |

| 5.196.116.238 | 443 | HTTPS | France | OVH SAS |

| 91.247.37.9 | 443 | HTTPS | Bulgaria | ITL Company |

| 93.95.97.20 | 449 | TCP? | Russia | JSC Mediasoft |

| 93.99.68.140 | 443 | HTTPS | Czech Republic | Liberty Global Operations B.V |

| 95.213.251.135 | 443 | HTTPS | Russia | OOO "Network of data-centers "Selectel" |

| hxxp://194.87.238.88/response.php | Russia | JSC Mediasoft | ||

| hxxp://66.70.172.120/response.php | Canada | OVH SAS |

Conclusion

Banking trojan authors rely on social engineering to trick banking customers into opening phishing emails and malicious files, clicking on malicious links in text messages, or clicking on malvertizing ads. Yet, it’s still not common practice for banks to provide security awareness training to their customers. This is likely due to legal concerns and the potential flood of costly customer service calls. In reviewing TrickBot's banking targets in this configuration, it’s clear that some banks, especially Islamic banks, have overcome the hurdle of offering security advice to customers on their websites. Security professionals within banks who are trying to fight the good fight should use these banks as examples in conversations with their legal teams and continue to push for security awareness training to their customer base. That includes the need for security controls on systems like anti-virus and patching, not just general social engineering or phishing awareness.

Security awareness, however, is a double-edged sword. It’s very important to educate the largely uninformed public on modern-day cyber fraud, but studies and real-world experience will both tell you that it’s not going to solve your problem, it will just help. No matter how much you train users, they will still click on spear-phishing emails. This is where advanced web protection services come in, especially for banks, where specialty services understand the specifics of how each banking trojan works, and offer customized detection and mitigation for customers. The customer’s device might be infected, but their session isn’t going to get hijacked, and their credentials aren’t going to get collected. For financial institutions who don’t want to invest in these types of experts in-house, outsourcing these types of services are a good idea.

MD5s Reviewed

1c1fb7eda90ac98f97d76c61080783b5

a2bbe6d113a8c67dede3b2aa91fe173a

8a86bec792b5341347bb6a63f4ffc9b9

Appendix A: All Businesses Targeted by v24

| Financial Institution | URL Count | Country |

| Credit Suisse | 36 | Australia, Austria, Bahamas, Brazil, France, Hong Kong, Italy, Luxembourg, Mexico, Monaco, Singapore, Spain, Switzerland, UK, US |

| Nordea | 35 | Denmark, Finland, Luxembourg, Norway, Singapore, Sweden, Switzerland |

| Danske Bank | 32 | Denmark, Finland, Lithuania, Norway, UK |

| SEB | 18 | Finland, Germany, Norway, Sweden |

| Barclays Bank | 15 | UK, Switzerland |

| Lloyd's Banking Group PLC | 14 | UK |

| HSBC Bank | 13 | Hong Kong, Singapore, UK |

| The Co-operative Bank | 10 | UK |

| Ulster Bank | 10 | Ireland, UK |

| NatWest | 9 | UK |

| Royal Bank of Scotland | 9 | UK |

| Bank of Scotland | 8 | UK |

| OP | 8 | Finland |

| Resurs Bank | 8 | Sweden |

| Santander Bank | 8 | UK |

| Citibank | 6 | EU, Singapore |

| J.P.Morgan | 6 | UK, US |

| Swedbank | 6 | Latvia |

| Isle of Man Bank | 5 | UK |

| Skandiabanken | 5 | Norway |

| Allied Irish Banks | 4 | Ireland |

| Bank of Ireland | 4 | Ireland |

| Banque Cantonale Vaudoise | 4 | Switzerland |

| Carnegie | 4 | Sweden |

| Coutts | 4 | UK |

| DBS Bank | 4 | Singapore |

| Deutsche Bank | 4 | Germany |

| ICICI Bank | 4 | India, UK |

| Investec | 4 | South Africa, UK |

| Marginalen Bank | 4 | Sweden |

| Metro Bank | 4 | UK |

| Nedbank | 4 | UK |

| OCBC Bank | 4 | Singapore |

| Paragon Bank | 4 | UK, US |

| Royal Bank of Canada | 4 | Canada, US |

| Standard Chartered | 4 | Singapore |

| TSB Bank | 4 | UK |

| United Overseas Bank | 4 | Singapore |

| Aktia Bank | 3 | Finland |

| Banco Pastor | 3 | Spain |

| Bank Cler | 3 | Switzerland |

| Bank Norweigian | 3 | Norway |

| CardOneBanking | 3 | UK |

| Scotiabank | 3 | Canada |

| State Street | 3 | US |

| The Bank of East Asia | 3 | UK |

| Triodos Bank | 3 | UK |

| Volvofinans Bank | 3 | Sweden |

| Abu Dhabi Commercial Bank | 2 | UAE |

| Abu Dhabi Islamic Bank | 2 | UAE |

| Adam and Company | 2 | UK |

| Airdrie Savings Bank | 2 | UK |

| AJ Bell | 2 | UK |

| Al Rayan Bank | 2 | UK |

| Aldermore Bank | 2 | UK |

| Amfa Bank | 2 | Sweden |

| Andbank | 2 | Andorra |

| ANZ | 2 | Australia |

| Arab Bank | 2 | Jordan |

| Arbuthnot Latham | 2 | UK |

| Baloise Bank | 2 | Switzerland |

| Baltic International Bank | 2 | Latvia |

| Banca March | 2 | Spain |

| Banco Mediolanum | 2 | Spain |

| Bank of Cyprus | 2 | UK |

| Bankia | 2 | Spain |

| Banque Nationale du Canada | 2 | Canada |

| Berner Kantonalbank | 2 | Switzerland |

| BHF-Bank | 2 | Switzerland |

| Blue Orange Bank | 2 | Latvia |

| BNP Paribas | 2 | France |

| *REDACTED | 2 | UK |

| Buckinghamshore Building Society | 2 | UK |

| Butterfield Bank | 2 | UK |

| C. Hoare & Co | 2 | UK |

| Cambridge and Counties Bank | 2 | UK |

| Cashplus | 2 | UK |

| Catella | 2 | Sweden |

| Cater Allen | 2 | UK |

| CBI | 2 | UAE |

| Cembra | 2 | Switzerland |

| Cetelem | 2 | Spain |

| Chorley Building Society | 2 | UK |

| CIMB Bank | 2 | Singapore |

| Close Brothers Asset Management | 2 | UK |

| Clydesdale Bank | 2 | UK |

| Commercial Bank of Dubai | 2 | UAE |

| Coventry Building Society | 2 | UK |

| Cumberland Building Society | 2 | UK |

| DNB Bank | 2 | Sweden |

| Dubai Islamic Bank | 2 | UAE |

| Duncan Lawrie | 2 | UK |

| EBS | 2 | Ireland |

| Ekobanken | 2 | Sweden |

| Emirates NBD Bank | 2 | UAE |

| Erik Penser Bank | 2 | Sweden |

| EVRY | 2 | Norway |

| First Direct | 2 | UK |

| First International Bank of Israel | 2 | Israel |

| First Trust Bank | 2 | UK |

| Folksam | 2 | Sweden |

| Forex Bank | 2 | Sweden |

| GE Artesia Bank | 2 | Netherlands |

| GE Capital | 2 | US |

| Gerrard Investment Management | 2 | UK |

| GT Bank | 2 | UK |

| Halifax | 2 | UK |

| Hampshire Trust Bank | 2 | UK |

| Hargreaves & Lansdown | 2 | UK |

| ING | 2 | Netherlands |

| Invest Bank | 2 | UAE |

| Ireland Bank | 2 | Ireland |

| Julius Baer | 2 | Switzerland |

| Kaupthing Bank | 2 | Iceland |

| Kleinworth Benson | 2 | UK |

| Luzerner Kantonalbank | 2 | Switzerland |

| Mashreq Bank | 2 | UAE |

| Max Matthiessen | 2 | Sweden |

| Maybank | 2 | Singapore |

| Medicinos Bankas | 2 | Lithuania |

| Merrill Lynch | 2 | US |

| National Bank of Abu Dhabi | 2 | UAE |

| NBAD | 2 | UAE |

| Netfonds Bank | 2 | Norway |

| Nettkonto | 2 | Norway |

| Neue Aargauer Bank | 2 | Switzerland |

| Neue Helvetische Bank | 2 | Switzerland |

| Newbury Building Socety | 2 | UK |

| Noor Bank | 2 | UAE |

| Northrim Bank | 2 | US |

| Norvik Banka | 2 | Latvia |

| Open24 | 2 | Ireland |

| POP Pankki | 2 | Finland |

| PostFinance | 2 | Switzerland |

| Raiffeisen | 2 | Switzerland |

| RAK Bank | 2 | UAE |

| Rathbone Brothers | 2 | UK |

| RCI Bank | 2 | UK |

| Re:member | 2 | Norway |

| Reliance Bank | 2 | UK |

| Reynolds & Reynolds | 2 | US |

| Saastopankki | 2 | Finland |

| Salesforce | 2 | US |

| S-Bank | 2 | Finland |

| Secure Trust Bank | 2 | UK |

| Shawbrook Bank | 2 | UK |

| Silicon Valley Bank | 2 | US |

| Societe Generale | 2 | France |

| Sparebanken Møre | 2 | Norway |

| St. James's Place Bank | 2 | UK |

| Standard Bank | 2 | UK |

| Standard Life Savings Limited | 2 | UK |

| State Bank of India | 2 | Singapore |

| Steinbach Credit Union | 2 | Canada |

| Storebrand Bank | 2 | Norway |

| Tesco Bank | 2 | UK |

| The Access Bank | 2 | UK |

| Tilney | 2 | UK |

| Toronto-Dominion Bank | 2 | UK |

| Turkish Bank | 2 | UK |

| UBS | 2 | Switzerland |

| UniCredit Bulbank | 2 | Bulgaria |

| United Arab Bank | 2 | UAE |

| United Bank UK | 2 | UK |

| Unity Trust Bank | 2 | UK |

| US Bank | 2 | US |

| Valiant | 2 | Switzerland |

| Virgin Money | 2 | UK |

| Voya | 2 | US |

| Yorkshire Bank | 2 | UK |

| Yorkshire Building Society | 2 | UK |

| Zenith Bank | 2 | UK |

| Zuger Kantonalbank | 2 | Switzerland |

| Zurcher Kantonalbank | 2 | Switzerland |

| Bank Leumi | 1 | UK |

| Bank von Roll | 1 | Switzerland |

| Nationwide Building Society | 1 | UK |