AI is accelerating how insurers manage risk, serve customers, and detect fraud. But the same tools that improve efficiency also introduce serious risks:

- Exposure of policyholder PII, claims history, and financial data

- Prompt injections manipulating claims outcomes or risk models

- Biased or hallucinated underwriting decisions leading to legal and reputational risk

- Lack of visibility into how AI recommendations are generated or applied

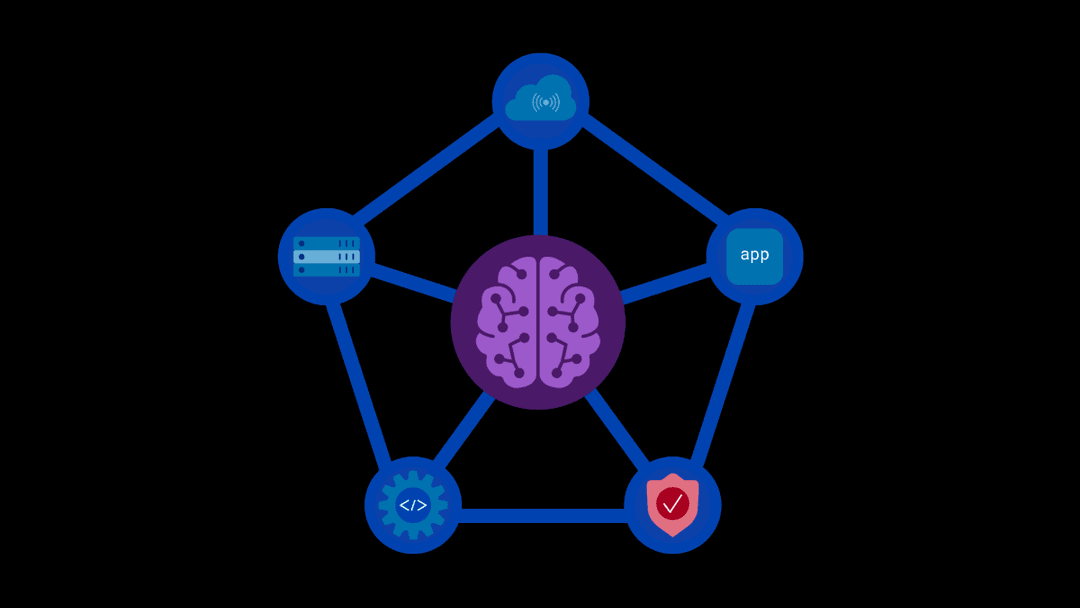

Our AI runtime security solutions secure the Insurance vertical with Red Team to validate, Guardrails to protect, and inbuilt Observability to govern AI deployments.

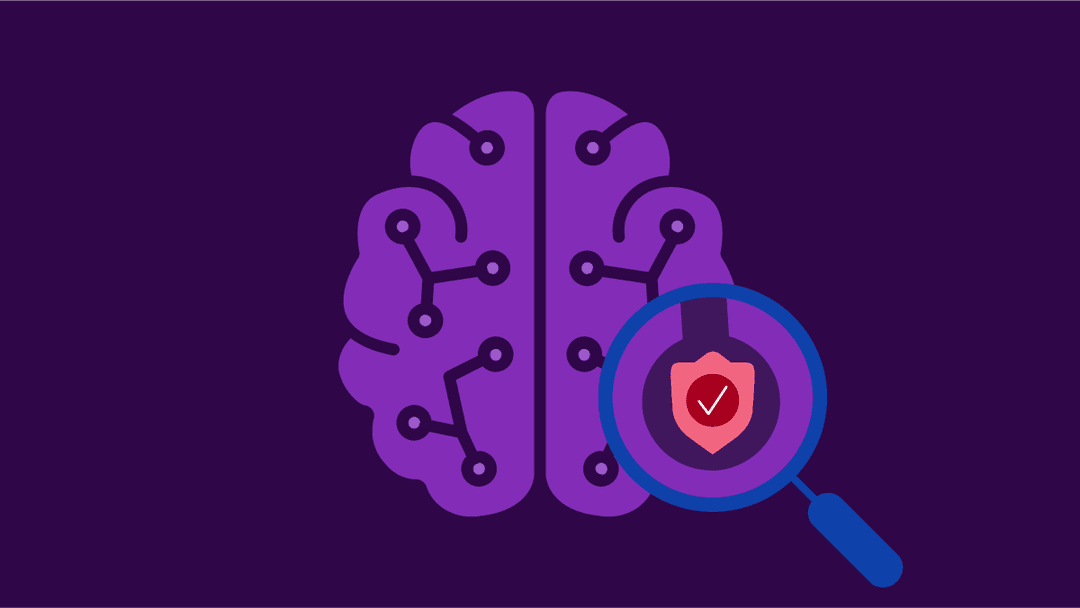

Red Team: Validate AI Before Policyholder Impact

F5 AI Red Team, previously named Inference Red-Team, proactively stress-tests insurance AI applications before they affect customers or operations.

- Agentic Resistance: Multi-turn adversarial campaigns simulating fraudsters or malicious insiders attempting to manipulate claims.

- Signature & Operational Attacks: 50,000+ evolving exploits uncover vulnerabilities in claims processing, fraud detection, and underwriting copilots.

- Insurance-Specific Testing: Evaluates whether AI could leak policyholder PII, generate biased risk assessments, or fail under operational stress.

Outcome for Insurers: Claims, underwriting, and fraud detection AI are validated and hardened before deployment.

Guardrails: Protect Claims & Risk Models in Real Time

Once deployed, AI Guardrails, previously named Inference Defend, protects insurance AI applications during live use.

- Data Protection: Blocks leakage of PII, financial details, or medical information from claims or underwriting systems.

- Stop Adversarial Exploits: Prevents prompt injections that could manipulate claims outcomes or risk calculations.

- Adaptive Controls: Security policies align to insurance regulations and compliance frameworks across multiple markets.

Outcome for Insurers: Trusted AI-powered claims and underwriting copilots that protect customers and business integrity.

Observability: Oversight for Compliance & Governance

In insurance, auditability and compliance are essential to managing regulatory risk. Our inbuilt observability features deliver complete oversight.

- Global Dashboards: A centralized view of AI usage and security events to enable compliance across the entire enterprise.

- Audit-Ready Logs: Capture every AI-driven decision or claim outcome for regulators, auditors, and customer dispute resolution.

- Policy Enforcement: Flags outputs that breach compliance requirements or produce biased/unfair results.

Outcome for Insurers: Transparent, defensible AI adoption that maintains compliance and customer trust.

Comprehensive AI Security for Insurance

With Red Team, Guardrails, and inbuilt Observability, insurers gain:

- Customer Data Protection: Keeps policyholder PII and claims records secure.

- Fraud Resistance: Hardens fraud detection systems against adversarial manipulation.

- Compliance Confidence: Simplifies adherence to insurance regulations and audit requirements.

- Operational Trust: Enables safe AI use across claims, underwriting, and customer engagement without introducing hidden risks.

AI Security Available as SaaS Point Solutions

AI Red Team and AI Guardrails can be deployed individually as software point solutions or together as a unified platform. This gives insurers the flexibility to secure AI-driven claims, underwriting, and customer engagement workflows while meeting regulatory demands.

The Bottom Line

Our suite of AI runtime security solutions secures the Insurance vertical by validating, protecting, and governing AI-driven claims, underwriting, and fraud detection — helping carriers and brokers innovate responsibly while safeguarding customer trust and regulatory compliance.

About the Author

Related Blog Posts

The hidden cost of unmanaged AI infrastructure

AI platforms don’t lose value because of models. They lose value because of instability. See how intelligent traffic management improves token throughput while protecting expensive GPU infrastructure.

AI security through the analyst lens: insights from Gartner®, Forrester, and KuppingerCole

Enterprises are discovering that securing AI requires purpose-built solutions.

F5 secures today’s modern and AI applications

The F5 Application Delivery and Security Platform (ADSP) combines security with flexibility to deliver and protect any app and API and now any AI model or agent anywhere. F5 ADSP provides robust WAAP protection to defend against application-level threats, while F5 AI Guardrails secures AI interactions by enforcing controls against model and agent specific risks.

Govern your AI present and anticipate your AI future

Learn from our field CISO, Chuck Herrin, how to prepare for the new challenge of securing AI models and agents.

F5 recognized as one of the Emerging Visionaries in the Emerging Market Quadrant of the 2025 Gartner® Innovation Guide for Generative AI Engineering

We’re excited to share that F5 has been recognized in 2025 Gartner Emerging Market Quadrant(eMQ) for Generative AI Engineering.

Self-Hosting vs. Models-as-a-Service: The Runtime Security Tradeoff

As GenAI systems continue to move from experimental pilots to enterprise-wide deployments, one architectural choice carries significant weight: how will your organization deploy runtime-based capabilities?